“Buy the dip” is a popular strategy in the cryptocurrency world where investors purchase assets after a price drop, hoping to profit when prices rebound. But timing the market isn’t easy—especially for beginners. This guide breaks down how to identify, analyze, and act on crypto dips while minimizing risks.

What Does “Buy the Dip” Mean?

“Buying the dip” means purchasing a cryptocurrency when its price drops significantly, anticipating it will rise again. For example, if Bitcoin falls 20% in a week, investors might buy during the decline to secure a lower entry price. However, success depends on understanding market cycles and avoiding emotional decisions.

Understanding Crypto Market Cycles

Crypto markets move in cycles: bull runs (prices rise), corrections (prices drop), and accumulation phases (prices stabilize). Recognizing these phases helps you decide when to buy.

1. Bull Markets

During bull markets, prices surge as optimism grows. Investors often “FOMO buy” (Fear of Missing Out) at peaks, which can lead to losses when corrections occur.

2. Bear Markets

Bear markets involve prolonged price declines. While risky, they offer opportunities to buy undervalued assets—if you’re patient.

3. Accumulation Phase

After a dip, prices often stabilize as savvy investors quietly accumulate assets. This phase signals a potential recovery.

How to Identify a Dip Worth Buying

Not every price drop is a good opportunity. Here’s how to spot a dip with rebound potential:

Check Historical Support Levels

Use tools like TradingView to identify price levels where the asset previously bounced back. Buying near support zones increases success odds.

Analyze Market Sentiment

Extreme fear (shown on the Crypto Fear & Greed Index) often signals overselling. Conversely, extreme greed may indicate a coming dip.

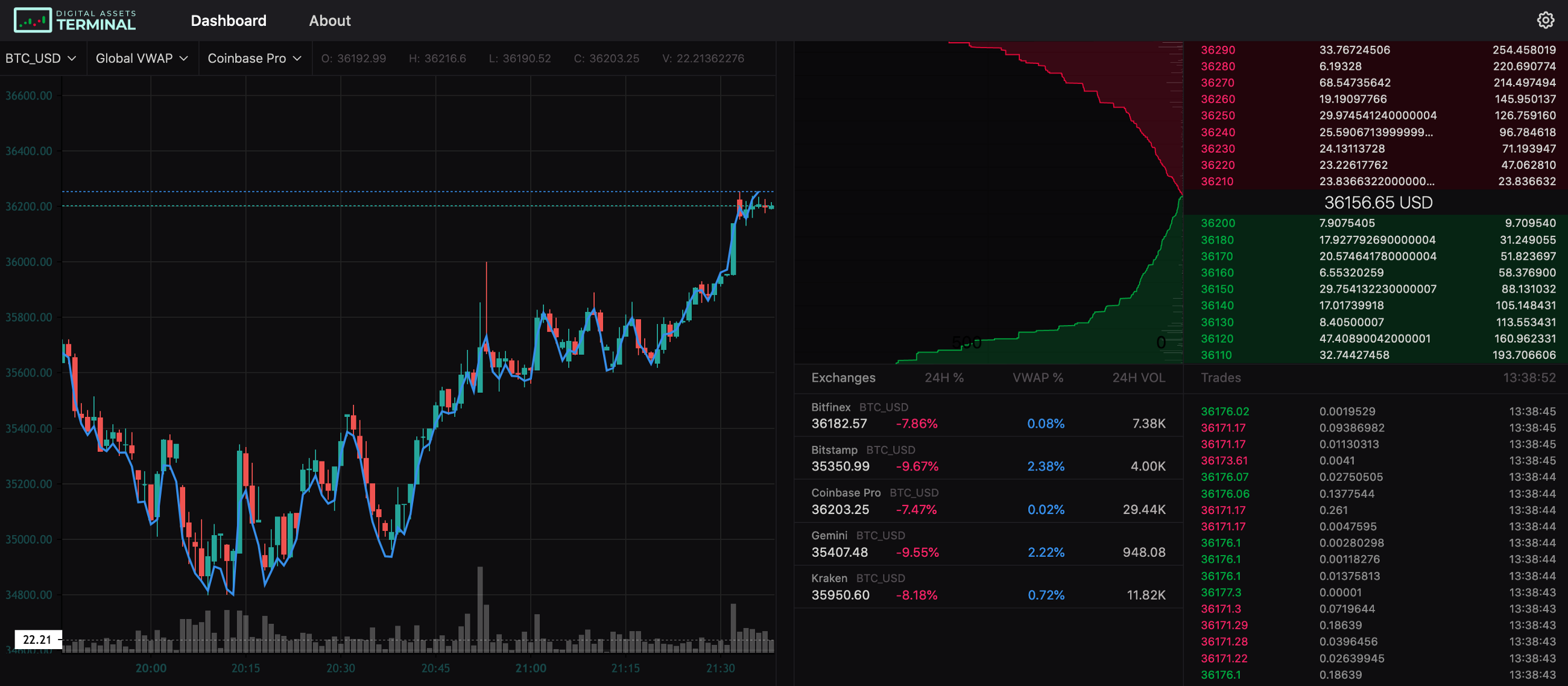

Use Technical Indicators

Tools like the Relative Strength Index (RSI) or moving averages help spot oversold conditions. An RSI below 30 suggests an asset may be undervalued.

Steps to Buy the Dip Safely

1. Set a Budget

Only invest what you can afford to lose. Never borrow money to buy crypto dips.

2. Use Dollar-Cost Averaging (DCA)

Instead of buying all at once, split your budget into smaller purchases over weeks. This reduces the risk of mistiming the market.

3. Place Limit Orders

Set automatic buy orders at your target price. For example, if Ethereum drops to $2,500, your exchange buys it instantly without manual intervention.

Common Mistakes to Avoid

Chasing “Dead Cat Bounces”

Some dips keep falling after a temporary bounce (like a “dead cat bounce”). Always verify trends before buying.

Ignoring Fundamentals

If a project’s fundamentals (e.g., team, utility) weaken, a price drop may be justified—not a buying opportunity.

Overleveraging

Avoid using high leverage to amplify gains. Sudden price swings can wipe out your funds.

Final Thoughts

Buying the dip can be profitable, but it requires research, discipline, and risk management. Start small, use tools like DCA, and focus on long-term trends rather than short-term hype. Remember: even experts can’t time the market perfectly!